A Portfolio Manager's Guide: Private Equity

A Portfolio Manager's Guide: Private EquityOnce an investor understands an asset class, the next important step before making an investment is to understand how to best integrate it into your overall portfolio. Here, we’ll briefly explore Private Equity (PE) from a portfolio manager’s perspective.

Consider the most common investment portfolio you can. It’s probably a combination of public equity (stocks) and public fixed income (bonds). Traditionally, investment managers might recommend a 60/40 portfolio of stocks/bonds for a moderate investor. This is often referred to as the 60/40 portfolio.

When thinking about placing money into Private Equity, a portfolio manager would evaluate how this new asset class would correlate and perform relative to the rest of the portfolio. Private Equity and Public Equity have a high level of correlation because both involve ownership of a company and are highly cyclical. They’re both accomplishing the same growth-oriented goals in your portfolio. We also know that historically the returns and risk within Private Equity have both been better than Public Equity. So, in our opinion, the best way to incorporate Private Equity into your portfolio is to remove a portion of Public Equity and replace it with PE.

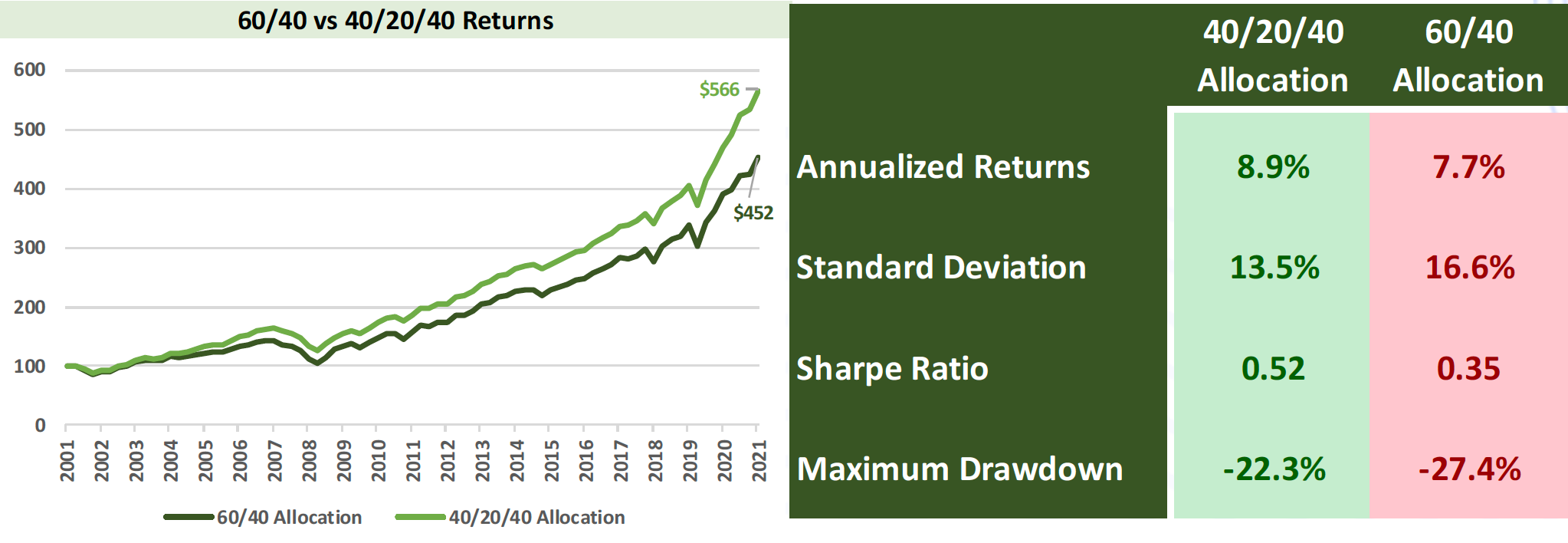

Let’s take a look at the common 60/40 Stocks/Bonds portfolio and compare it to a 40/20/40 Stocks/PE/Bonds portfolio over the last twenty years. We’re only replacing 20% of the model with Private Equity, but we’re doing it directly out of the Public Equity allocation.

* Source: Bloomberg, Cambridge Associates 12/31/2001 – 12/31/2021

Pretty phenomenal results for just a 20% adjustment! Compound annual growth rate increased from 7.7% to 8.9%, volatility was cut from 16.6% to 13.5%, and the maximum drawdown was slashed from 27.4% to 22.3%. Replacing more of the public equity with Private Equity would only improve those results.

To take action on this data and consider making an allocation to Private Equity, click here to learn more and take next steps. For more information around PE, please see the Privates School: Private Equity educational piece.

For disclosure:

Private Equity: Pitchbook US Private Equity Index Public Equity: S&P 500 TR Index

Fixed Income: Bloomberg US Aggregate Bond TR Index