Tax Planning for Liquidity Events: Minimizing Taxes

Tax Planning for Liquidity Events: Minimizing TaxesThis paper assumes that the readers’ company’s acquisition has already been completed and the reader is a US citizen.

There are a number of tax planning options to reduce or eliminate federal, state, and local income tax before the acquisition is completed; e.g. moving to a state with no income tax months in advance of your company’s transaction closing.

Not tax advice. Please consult a tax professional to assess your specific tax situation.

Not investment advice. Please consult an investment professional to assess your specific investment needs.

Congratulations! You just enjoyed one of the most exciting events in business; a company - in which you have a material stock holding - has been acquired!

This type of acquisition event is special and very few individuals have the chance to benefit from them.

While an acquisition event brings the excitement of realized new found wealth, it is also a material tax event.

Taxes related to acquisition events may feel like a punch in the gut especially in high income tax states.

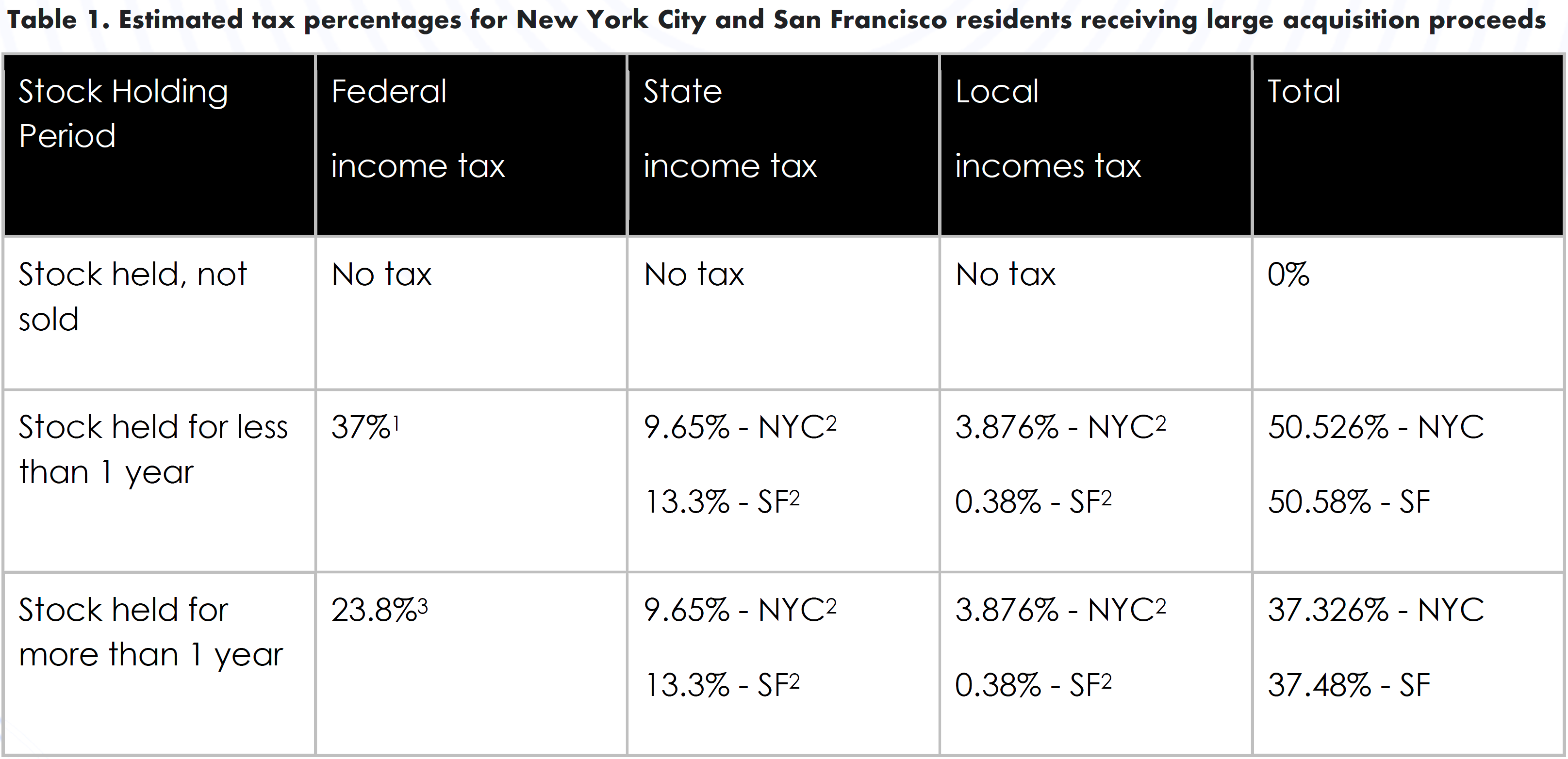

For example, California and New York residents may pay north of 50% of their acquisition proceeds in taxes (i.e. federal, state, and local short term capital gains tax). Imagine realizing a liquidity event gain of $5.0 million but only bringing home $2.5 million after taxes. Ouch.

Table 1 provides the estimated tax percentages that New York City and San Francisco residents pay when receiving large acquisition proceeds.

Tax planning - or understanding the federal and state tax codes to file your taxes correctly - may delay, reduce, or eliminate capital gains tax. This paper’s goal is to reduce or eliminate taxable income by delaying the realization of a capital gain or allocating your acquisition proceeds to investments that deliver an income tax deduction in the acquisition event tax year.

We highly recommend that you work with both [1] an accountant with tax expertise and [2] a financial advisor to effectively plan for taxes surrounding your acquisition event. These professionals will use a combination of the following to reduce or eliminate your acquisition event tax liability;

Tax planning - e.g. Sell current investments that have a capital loss to offset the capital gain from your liquidity event.

Cash flow advice - e.g. Do not pay off your mortgage! Most homeowners refinanced in the last few years locking in a very low, long-term interest rate. This interest rate is most likely materially below the expected investment returns earned from the stock market or alternative investments. This spread - expected investment return minus mortgage interest rate - is a contributor to your net worth.

Asset location - e.g. Contribute to a private foundation, donor advised fund, individual retirement account (IRA), health savings account (HSA), or 529 college savings account (529) to reduce taxable income and delay - and possibly eliminate - capital gains tax.

Investment products - e.g. Invest into private real estate with high cost segregation or bonus depreciation to pull forward depreciation and reduce taxable income.

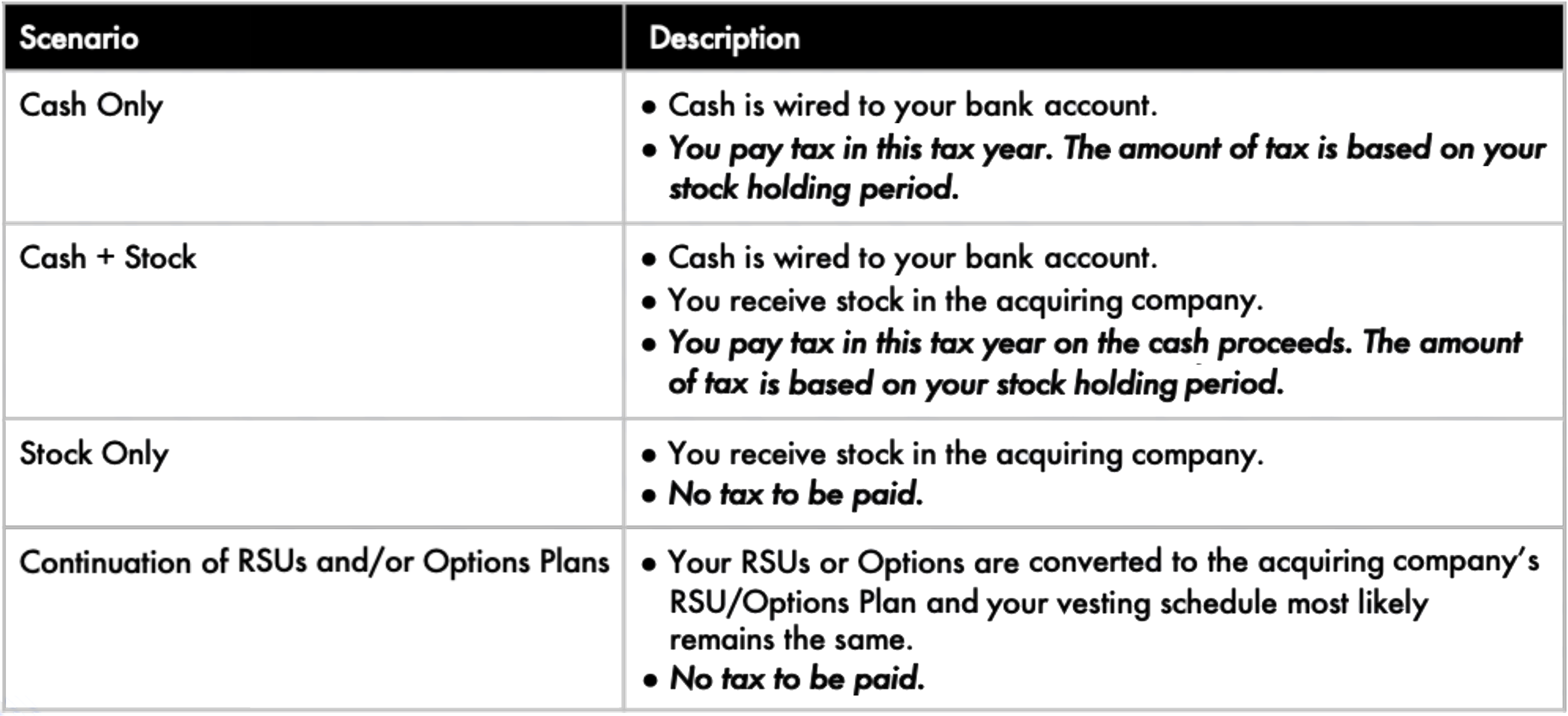

In general, acquisition events fall into one of the following scenarios…

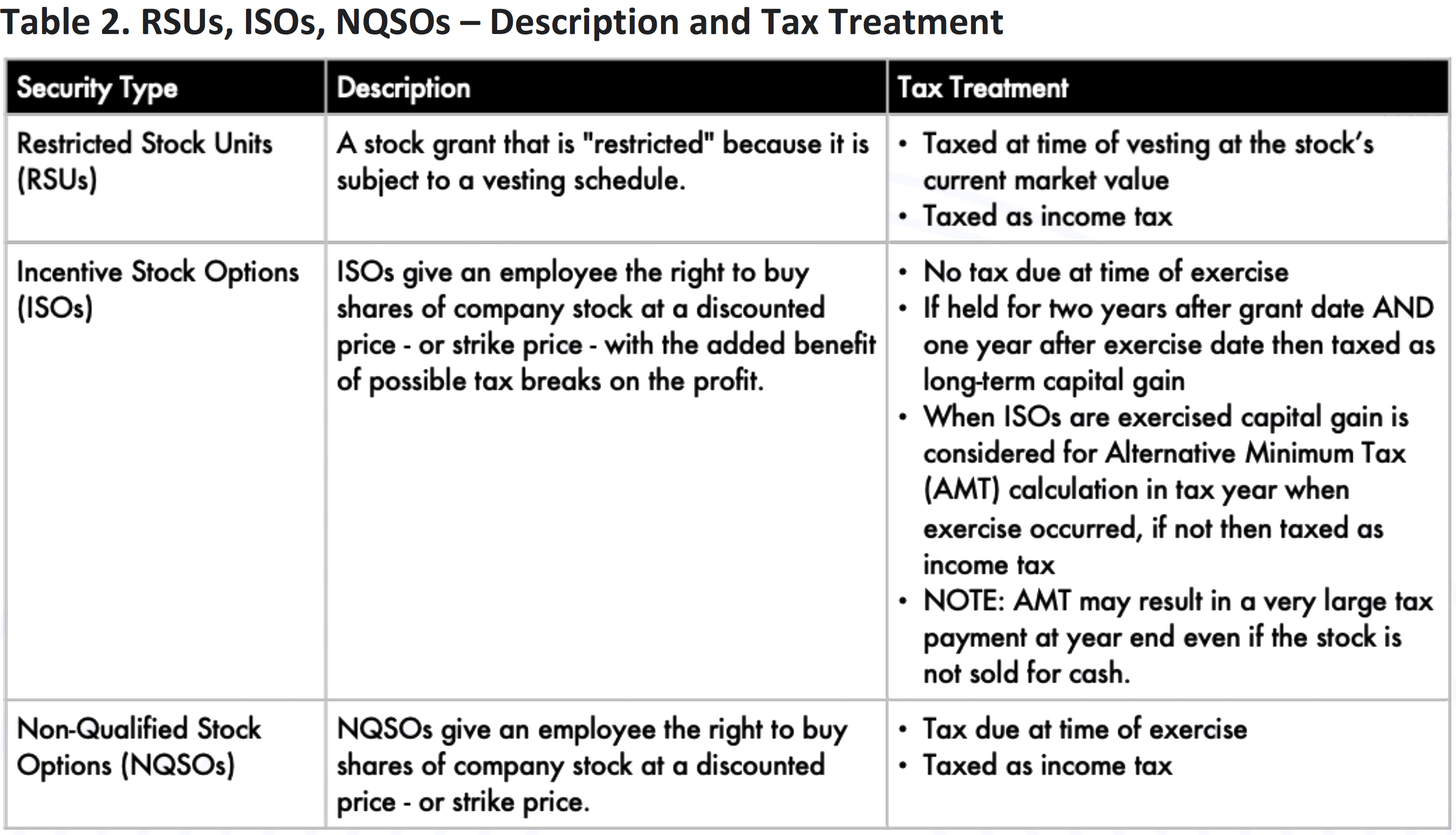

The tax treatment for RSUs or stock options are very complex. Table 2 provides a summary for the tax treatment of each.

IMPORTANT: There are a number of tax planning strategies to consider if the acquiring company is private vs public. Notable strategies include…

ISOs: Exercise, hold, borrow. If the acquiring company is publicly traded, you may borrow against your position from your brokerage firm. This is called margin lending and you may simply withdraw cash to your checking account. Margin rates can be attractive compared to other types of lending products. There is nuance around margin lending so consult your financial advisor prior to pursuing margin to understand the risks and ensure you are charged a fair interest rate.

NQSOs: Ability to sell. NQSOs may be golden handcuffs. For example, an employee has a large amount of NQSOs that have appreciated significantly. Tax is due on exercise of the NQSOs. If your company is [1] private and [2] does not offer a cashless exercise - or the ability to pay for the tax due at exercise with company stock - then you are required to pay the tax bill due at exercise with cash. Many do not have the cash available to make this payment. This scenario forces you to stay with the company until they go public, i.e. golden handcuffs. Alternatively, if your company is public after being acquired you may exercise your NQSOs via a cashless exercise at your discretion or exercise the options, pay the exercise price and tax bill with stock, and hold the remaining stock in hopes of further appreciation. As noted above, you may also borrow against any stock that you hold in your brokerage account.

Qualified Small Business Stock (QSBS) allows shareholders to sell their qualified small business stock and pay no Federal capital gains tax up to $10 million or 10x the adjusted cost basis of the stock. Most states have the same QSBS tax laws in place with a few exceptions so please consult a tax advisor to best understand your specific tax situation.

A company must meet the following qualification requirements to be considered a qualified small business:

Incorporated as a U.S. C-corporation

Have gross assets of $50 million or less at all times before and immediately after the equity was issued

Is not an excluded business type; notables include businesses in health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, banking, insurance, financing, leasing, investing, hotel/motel, restaurants

Shareholders that own company stock - founders stock, purchased stock, vested from RSUs, or issued from an exercise of ISOs/NQSOs - must hold that stock for at least five (5) years in order to qualify for QSBS. Note: the five year QSBS clock does not start for RSUs, ISOs, and NQSOs until the shareholder owns the stock directly (RSUs vest, ISOs/NQSOs are exercised).

Hold, Borrow, Die. If [1] the acquiring company is public and [2] the acquisition terms result in you receiving the acquiring company’s publicly traded stock (or continuation of the RSU and/or ISO/NQSO plans) you are eligible to borrow against your stock position using brokerage margin.

Simply contact your brokerage firm and ask them to turn on margin for your account. You’ll be able to borrow up to 50% of the value of your stock value. NOTE: Speak with your financial advisor to ensure that you understand the risks of margin loans and are receiving the best interest rate.

A margin loan will deliver the following benefits…

Delay capital gains tax until a future date while providing access to cash.

Allow your stock investment to potentially appreciate while providing access to cash. Ideally the stock appreciation is greater than the margin loan interest rate, a contributor to your net worth.

When you die and transfer the stock to your heirs the cost basis will “step-up” to the market value on the day of your death eliminating all capital gain tax owed.

Exchange Funds. Exchange Funds accept your single stock position without selling it in exchange for a basket of stocks that seek to track the S&P 500 Index, or the broader US stock market. There is a required seven (7) year holding period. At the end of the seven years, you’ll receive a pro-rata share of all stocks in the Exchange Fund.

Exchange Funds offer the following benefits…

Delay all capital gains and potentially eliminate capital gains if you never sell the pro-rata share of stocks received from the Exchange Fund at the end of the 7th year.

Allow you to diversify your portfolio away from a large single stock position to a diversified pool of stocks

Many feel compelled to donate a portion of their proceeds from an acquisition to charity. Charitable donations reduce your taxable income in the tax year the donation is made. How, when, and how much are important considerations to ensure you maximize your charitable impact and maximize your tax deduction.

Regardless of how you elect to proceed with your charitable giving it is important that you always donate highly appreciated stock vs cash. When donating highly appreciated stock to a charity you receive two tax benefits.

You do not pay capital gains tax on the stock position

Your donation is tax deductible

There are three types of charitable giving mediums to consider.

Direct Charitable Giving. If you have a charity in mind simply donate your highly appreciated stock position to the charity. All charities are able to accept (or can easily set up the ability to accept) stock donations.

Donor Advised Fund. If you are unsure about which charity should receive your donation, a donor advised fund may be the right answer. Your contribution to the donor advised fund is tax deductible in the year made and you may invest in stocks/bonds while you make your decision.

Private Foundation. Similar to a donor advised fund, a private foundation is a great solution if you are unsure of what charity should receive your donation. You also receive the tax deduction in the tax year the donation is made. Private foundations also give you more control on how funds are donated (i.e. grants to individuals, donations to charities). Funds in a private foundation may also be invested. While investments may be made into any type of asset (with some exceptions) you may also invest with purpose effectively doubling the charitable impact of your donation. For example, if you seek to donate funds to charities focused on climate change you may also invest the private foundation’s funds into companies that are working on climate change solutions. Private foundations can be expensive to establish and there are strict rules to follow to ensure that the foundation maintains its charitable tax status so be sure to work with a qualified lawyer, tax advisor, and financial advisor when establishing your private foundation.

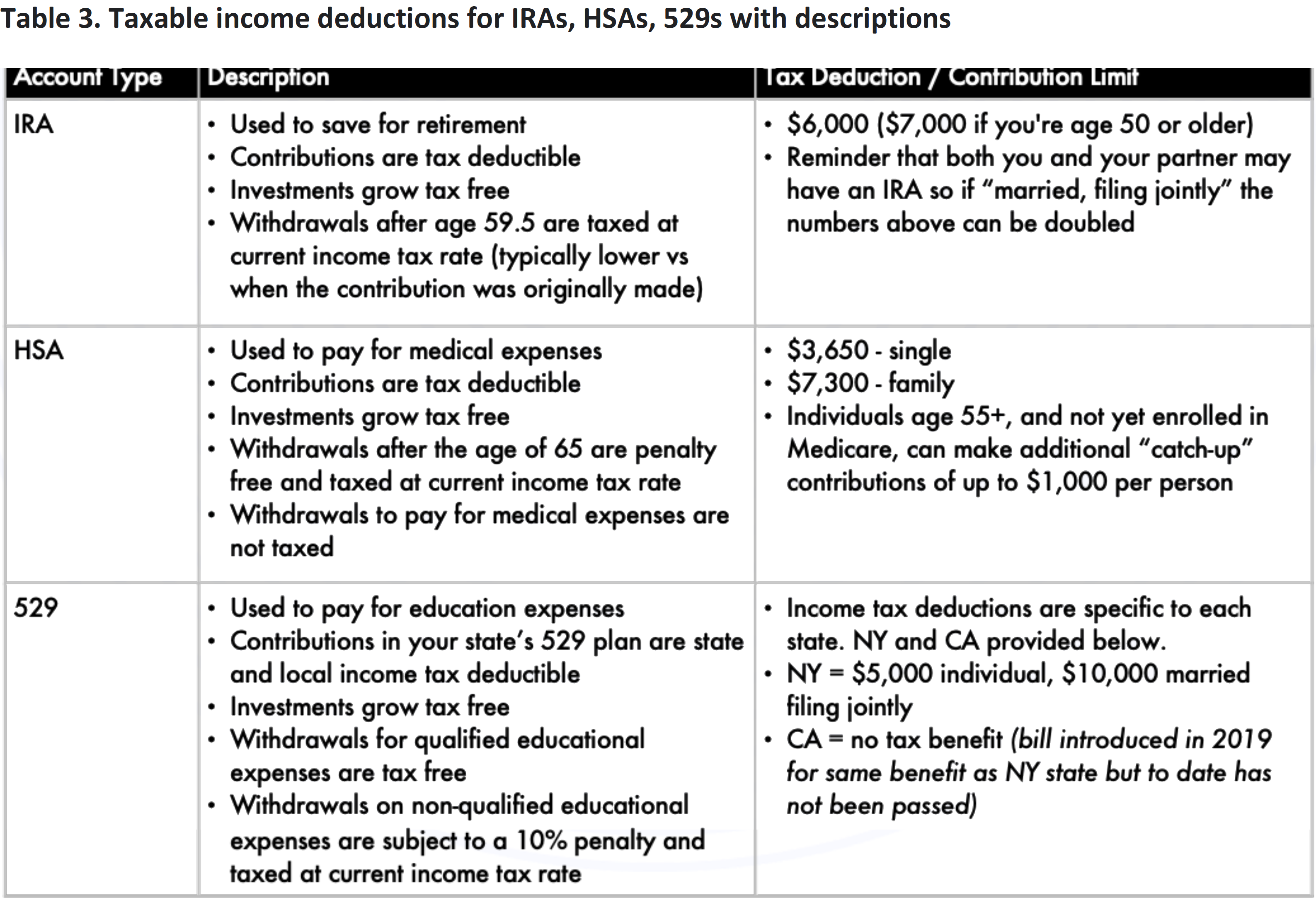

Contributing to an individual retirement account (IRA), health savings account (HSA), and/or 529 college savings plan (529) may also reduce your taxable income. Table 3 provides the taxable income deductions for 2022.

NOTE: Alternative investments are complex. Please speak with your financial advisor and tax advisor before investing.

Real Estate. Real estate investments benefit from depreciation, or the value of the asset becoming less valuable over time. In some instances, depreciation may be so large that it offsets income generated by the asset resulting in a net loss and - ultimately - reducing taxable income.

Certain types of real estate may also benefit from cost segregation depreciation. Cost segregation depreciation breaks down real estate into its components to accelerate depreciation. This acceleration increases the amount of depreciation posted in early years of the investment and, in some cases, 30-35% of your building’s original purchase price could be written-off in the first year.

Also important, depreciation is based on the full value of the real estate. This means you can buy a $1.0 million property with a $200,000 down payment and $800,000 in financing but benefit from $300,000 to $350,000 in first year depreciation.

Bonus Depreciation from Businesses with Qualified Property. Certain qualified property may be depreciated on an accelerated timeline. The 2017 Tax Cuts and Jobs Act (TCJA) also allowed “qualified property” for businesses to receive “bonus depreciation”.

Under the TCJA, bonus depreciation allows for a 100% first-year deduction for qualified business property that is acquired and placed in service after Sep 27, 2017 until Dec 31, 2022.

After Dec 31, 2022, the deduction for first-year bonus depreciation changes according to the following schedule:

80% for property placed in service between January 1, 2023 and December 31, 2023.

60% for property placed in service between January 1, 2024 and December 31, 2024.

40% for property placed in service between January 1, 2025 and December 31, 2025.

20% for property placed in service between January 1, 2026 and December 31, 2026.

Examples of “qualified property” include…

Gas stations

Airplanes

Boats (charter business, commercial fishing)

Geothermal, solar, and wind energy property

Motorsports entertainment complex property

Wineries (trees and farm equipment/buildings)

Municipal wastewater treatment plant

Natural gas distribution lines

Telephone distribution plant and comparable equipment (cell phone towers)

Municipal sewers

Similar to cost segregation depreciation, bonus depreciation is based on the full purchase price of the qualified property. This means in 2022 you can buy a $1.0 million of qualified property with a $200,000 down payment and $800,000 in financing but benefit from $1,000,000 in first year depreciation.

Opportunity Zones. Opportunity Zones are an economic development tool that allows you to invest in distressed areas in the United States. Their purpose is to spur economic growth and job creation in lowincome communities while providing tax benefits to investors.

Investing in Opportunity Zones allows you to defer the capital gain you incur after your company stock is sold. You’ll have 180 days after the sale of your company stock to invest into a Qualified Opportunity Zone Fund.

A Qualified Opportunity Zone Fund investment provides potential tax savings in two ways;

[1] Tax deferral through 2026 –Any taxable gain invested in a Qualified Opportunity Zone Fund is not recognized until December 31, 2026, or until the interest in the fund is sold or exchanged, whichever occurs first.

[2] No tax on appreciation - Remaining in the Qualified Opportunity Fund for at least 10 years results in the cost basis of the property being equal to the fair market value on the date of sale/exchange.

QSBS Qualified Venture Capital / Private Equity (i.e. Small Businesses). If your company stock is [1] a QSBS and [2] you’ve held it for less than 5 years you may want to consider a Section 1045 Rollover. (See QSBS section above for more details on how a company qualifies as a QSBS and the resulting tax benefits.)

Section 1045 details the process to exchange your Original QSBS for Replacement QSBS, continuing the five (5) year holding period to meet the QSBS holding period requirement. The start date of the holding period remains the date on which the Original QSBS was acquired.

You must own the Original QSBS for six (6) months to qualify for a Section 1045 Rollover. Only the amount invested into the Replacement QSBS is eligible to defer capital gains. You have 60 days from when your Original QSBS is sold to perform the rollover and the Replacement QSBS must remain eligible as a qualified small business for six (6) months after the acquisition of the Replacement QSBS in order for the investment to maintain its status as QSBS.

Replacement QSBS, C-corp’s, and Section 1045 Rollovers. 60 days is not a lot of time to identify, negotiate, and close a Replacement QSBS investment. The IRS does allow you to set up a newly-incorporated C-corporation, fund this NewCo with proceeds from the sale of Original QSBS, and continue the five (5) year QSBS holding period requirement. You are then able to make investments in Replacement QSBS on a more reasonable time table.

AG Dillon & Co

Managing Director

1167 2nd Ave, Suite 2N NYC

e. aaron.dillon@agdillon.com

c. +1 347 642 2640

5,500%+ realized return on SoFi pre-IPO stock investment

4,000%+ unrealized return on KraneShares ETFs pre-IPO stock investment

10 other pre-IPO stock investments including SilkFAW (www.silkfaw.com), Public.com, Callin (www.callin.com), Kinly (www.bekinly.com), Paga (www.mypaga.com)

Assisted 40+ fintech challenger banks launch online bank account offerings, assisted with seed capital raising (SoFi/Galileo, www.galileoft. com)

Co-founded KraneShares ETFs and ran day-today operations for SEC 1940 Act funds

Head of wealth management division at FTSE Russell Indices and constructed indices for ETFs, direct indexing, and passive SMAs

Managed investment product platforms at Morgan Stanley Wealth Management and TD Ameritrade and ensured compliance with SEC and Finra regulation while understanding and meeting financial advisor needs.

SoFi – Managing Director – Wealth Management, Galileo division

London Stock Exchange / FTSE Russell Indexes – Managing Director, US Wealth Mgmt

KraneShares ETFs – Co-founder, Managing Director

TD Ameritrade – Director, Head of Mutual Fund & ETFs

Morgan Stanley Wealth Management – VP, Investment Products & Managed Accounts

Federal income tax brackets = https://taxfoundation.org/2022-taxbrackets/

NY state and NYC income tax brackets ($1.0m to $5.0m bracket) = https://www.nerdwallet.com/article/taxes/new-york-state-tax ; CA state income tax brackets = https://www.nerdwallet.com/article/taxes/california-state-tax ; CA state income tax includes a 1% mental health services tax applies to income exceeding $1 million ; San Francisco income tax = https://www.stlouismo.gov/government/departments/comptroller/initiatives/us-citiesthat-levy-earnings-taxes.cfm

Federal capital gain tax and net investment income tax = https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

Cost Segregation:

Bonus Depreciation:

Opportunity Zones:

https://www.irs.gov/credits-deductions/businesses/opportunityzones

https://www.wellsfargo.com/the-privatebank/insights/planning/wpu-qualified-opportunity-zones/

QSBS Section 1045 Rollover:

© 2022 AG Dillon LLC and its affiliates (“AG Dillon & Co”). All rights reserved.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the AG Dillon & Co, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided "as is" without warranty of any kind. No member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the AG Dillon & Co Index Products or the fitness or suitability of the AG Dillon & Co Index Products for any particular purpose to which they might be put.

Any representation of historical data accessible through AG Dillon & Co Index Products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analyzing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the AG Dillon & Co is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors provide investment advice related to AG Dillon & Co Indices and nothing contained in this document or accessible through AG Dillon & Co Index Products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from quarter to quarter based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the AG Dillon & Co nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the AG Dillon & Co. Use and distribution of the AG Dillon & Co data requires a license from AG Dillon & Co.