The Case for Private Investment Allocations

The Case for Private Investment AllocationsSince the dotcom market bubble, the invisible hand of the Federal Reserve, and other global central banks became not so invisible. In fact, the Federal Reserve became the biggest player in capital markets. That has never been more evident than in recent years in which we have witnessed the Federal Reserve become a huge buyer of Treasuries, mortgage-backed securities, and corporate bonds of all varieties (including bankrupt companies). Furthermore, the Fed made the ultimate backstop to markets by saying that they would be buyers of assets for as long as it takes (QE infinity). When one considers global central banks, the amount of stimulus only stretches further. Negative interest rates and equities purchases are quite commonplace. That is just central bank stimulus. We haven’t even begun to peek into the record amounts of fiscal stimulus globally. The world really is awash in liquidity.

The problem with all of the stimulus is that it seeks after short-term outcomes while negating the potential long-term consequences. The reason is because it shrinks the available pool of longterm investment opportunities. How this happens is through a risk spectrum shift. Essentially, by pushing rates to negative, cash is worth nothing and savers are penalized. The saver must now take risk to earn a return. In other words, the saver is now a speculator, investor, or lender. The more the Fed buys assets and continues to creep up the risk spectrum as well, the further an investor is pushed to earn a return. Now, we have reached a time period where valuations suggest that stocks, bonds, and cash are set to earn negative returns over the next 10-12 years on average. The Fed is crowding out investors and pushing people to take more and more risk in order to generate a return.

We feel bad for the investors that are passively tied to a blend of market index funds at this stage in the cycle. Especially those investors that have been forced into risk to try and keep pace with the dollar debasement (inflation). Unfortunately, even advisors and wealth management companies have moved largely to passive index funds and public market vehicles. We face a time where we believe clients are vastly underexposed to private assets. Sure, valuations are not great for all private markets. In fact, there are several areas that are extremely overvalued. However, they still have an element of risk left to capitalize on, illiquidity. In addition, good active management is critical in private markets and we would rather rely on the skill and solid processes of experienced professionals. Good active managers know how to leverage their resources to help companies realize operational efficiencies, scale, and generate returns on invested capital.

The greater decentralization trend that we are experiencing also favors private versus public markets. Investing in some of the biggest technological innovations of our history is possible in private markets before they reach the extreme valuations of the post IPO public markets. More and more opportunities are emerging as large centralized organizations and infrastructure give way to more decentralized networks. Just think back to the first wave of decentralization in media. Large companies dominated the media and content ownership game before networks like Facebook, Youtube, Twitter, and others emerged. If you accessed these companies as a venture capital investor, you saw significant value appreciation by the time these organizations went public. We are now seeing the decentralization of ownership shift from centralized organizations who provide platforms for collecting data and selling attention to advertisers to the content creators themselves. These new disruptors could present amazing opportunities in the private markets like the technology companies before them.

The way things are going, it seems as if it is only a matter of time before decentralization allows for more access to private investments. Blockchain looks sure to open this world up to investors that may have not been exposed in the past. Expected returns are already low (relative to history) for many private markets. Can you imagine if access continues to accelerate and tokenization allows for anyone to invest in these markets, regardless of investor status? Returns will move lower, cap rates on real estate will move lower, valuations will become stretched. Private markets, at least for now, may still have a little gas left in the tank.

If you ask most investors, they will be able to tell you what a stock or a bond is. You may have less luck finding investors who can identify different private assets, what they invest in, and what the merits are for investing in them. This is not unusual. Until recently, private assets were reserved for only the wealthiest of investors. While significant requirements remain for most private assets, special fund structures and a relaxation of some investor qualification requirements have made private market assets more accessible. On that note, let’s explore what we mean when referring to private assets and some of the benefits to investing in them. To start it is important to point out that there is a myriad of private assets in today’s day and age, but for purposes of this paper we will focus on the big four: hedge funds, private equity, private credit, and private real estate.

Hedge funds are undoubtedly the most well-known private asset, and despite declines in recent years, hedge funds also remain the most prevalent private asset in terms of number of active funds (McKinsey). With hedge in the name, you may be able to deduce that these investments are designed to try and achieve returns better than their benchmark with less risk. Hedge funds often trade public securities, but they do so with greater flexibility versus a traditional mutual fund, due to the reduced regulation of the fund structure. As an example, greater flexibility may mean that a fund can amplify their returns by using large amounts of leverage. While the types of hedge funds that exist vary quite a bit, some of the more well-known strategies are long/short, global macro, and multi-strategy. Long/short strategies take long and short positions in equities or credit so they can try and achieve returns if those positions increase or decrease in value. These types of strategies use their short positions to minimize exposure to the market to help reduce risk and gain additional return above that of a traditional long-only strategy. Global macro strategies are typically unconstrained in where they can go to find opportunities for returns. Often these funds will focus heavily on economic data and political events from across the world to find opportunities in equities, credit, currencies, commodities, etc. Multi-strategy funds are unique in that they combine various strategies into one fund. For instance, a multi-strategy fund may combine long/short equity, long/short credit, and long volatility. This approach helps diversify exposure across different strategies that may perform better at different times.

Private equity is another quintessential private asset. The name of the game with this asset class is to identify attractive companies, take ownership stakes in them, help these companies grow and/or improve, and then re-sell them later – ideally at a much higher price than what they paid. This is an oversimplification of the asset class; however, it provides a general sense of what they set out to do. Within the private equity asset class there are quite a few different types of strategies that managers can employ which include: venture capital, growth equity, buyout, and distressed. These strategies aim to invest in companies at different stages of their lifecycle. Venture capital is the earliest stage where investments are made in companies that are just developing or starting to grow. These companies are not yet fully proven, and sometimes may not even have a finalized product yet, therefore the risk of failure tends to be much higher. In fact, in a portfolio of ten companies, venture capital firms typically lose money on three or four companies, have their original investment returned in three of four companies, and then make outsized returns on the remaining companies (WSJ). Those outsized returns tend to make up for the losses and lack of gain in the other investments and then some. Buyout strategies are the most common type of private equity and are usually what investors think of if they are somewhat familiar with private equity in general. Buyout strategies purchase more mature companies and take control of the business. They aim to add value to these companies in one form or another in hopes that they will be able to sell the company for a higher price tag later. Buyout managers’ value add capabilities range, but this could be via expense reduction or operational efficiency improvements. The use of leverage is a key return driver of buyout investments. Growth equity and distressed strategies are smaller segments of the market, but still warrant explanation. Growth equity strategies focus on companies that are slightly more mature than a venture capital target, but not quite mature enough to be a viable target for a buyout firm. These companies tend to need capital to sustain their growth in hopes that they turn a profit. Distressed strategies, also known as special situations, focus on companies that have undergone a significant event that requires a massive turnaround effort, such as a bankruptcy (Mercer).

Private credit is one of the broader private asset classes. The general underlying strategy of this asset class is to either invest in the debt of companies or to provide capital to companies for various corporate purposes. Private credit has exploded as an asset class in the wake of the Global Financial Crisis as banks have had to back away from certain lending practices on the back of stricter regulation (Preqin). Typically, private credit can be utilized as an income-oriented strategy or as a total return strategy (Cambridge). Income-oriented strategies will derive their returns from cashflows on the loans made to companies. Total-return strategies will derive their returns not only from income, but also in the form of equity interests, loan fees and discounts, and capital appreciation of the underlying investments. Some examples of underlying private credit strategies are direct lending and distressed credit. Direct lending falls under the incomeoriented strategies as these funds focus on making loans directly to companies with investors earning their returns in the form of income generating on these loans. There is less risk inherent in direct lending strategies because the loans themselves typically sit very high in the capital structure, mitigating the risk of loss in the event of a negative corporate event for the company.Distressed credit would be considered a total return strategy as investors can be compensated by both income from the distressed debt that is purchased in addition to capital appreciation of the debt value.

Private real estate is one private asset that is relatively straightforward to understand. Private real estate can be classified as either debt or equity investments in real estate properties. Within the landscape of equity-oriented private real estate there are different types of strategies that these firms can pursue. The primary types of private real estate are core, core-plus, value-add, opportunistic, and distressed. Core strategies invest in fully stabilized (leased) properties, that are high-quality, and in desired areas. Core-plus strategies invest in properties that are like Core properties, but additional value may be realized if certain improvements are made. Value-add strategies look to invest in properties that require certain improvements with the hopes that these improvements will increase the value of the property so it can be sold for a gain. Opportunistic strategies aim to invest in projects that are riskier but could lead to significant returns should the real estate projects succeed. These strategies typically develop real estate properties from the ground up or purchase properties that require significant improvements. Lastly, distressed real estate strategies focus on investing in properties that are damaged or have issues with management and/or tenants that the purchaser hopes to correct to sell the property for a gain (Preqin). These types of private real estate strategies can be applied to the different subsectors of real estate which are: hotel, multifamily, office, retail, and industrial (NCREIF).

While hedge funds, private equity, private credit, and private real estate differ greatly, there are similarities in the fee structure, fund structure, and investor requirements for each of these assets. As we mentioned at the beginning of this paper, most private market assets require investors to meet certain requirements to invest. These requirements are largely based on the level of assets an investor owns but can also be satisfied by investor experience or income in some cases. Private market assets are accessed via pooled investment vehicles, such as limited partnerships. While there are shortcomings to this structure, the limited partnership structure has benefits that we will explain in greater detail later in this paper. Fees are generally structured the same across these asset classes with management fees and incentive fees being charged on assets invested with these funds. While most private market assets are criticized for high fees, we believe that fees only become an issue in the absence of value. As we discuss later in this paper, we believe that significant value can be created in the private markets, therefore justifying the fees that are charged.

In this portion of the paper we analyze valuations, in both the private and public markets. For the purposes of this paper we focus on private equity buyout revenue multiples versus public market revenue multiples. Private market and public market valuations are both high in our opinion, but we outline why a premium in the private space carries less worry than a public market premium. We believe the public markets are undeniably overvalued and believe most market participants are aware of these elevated levels.

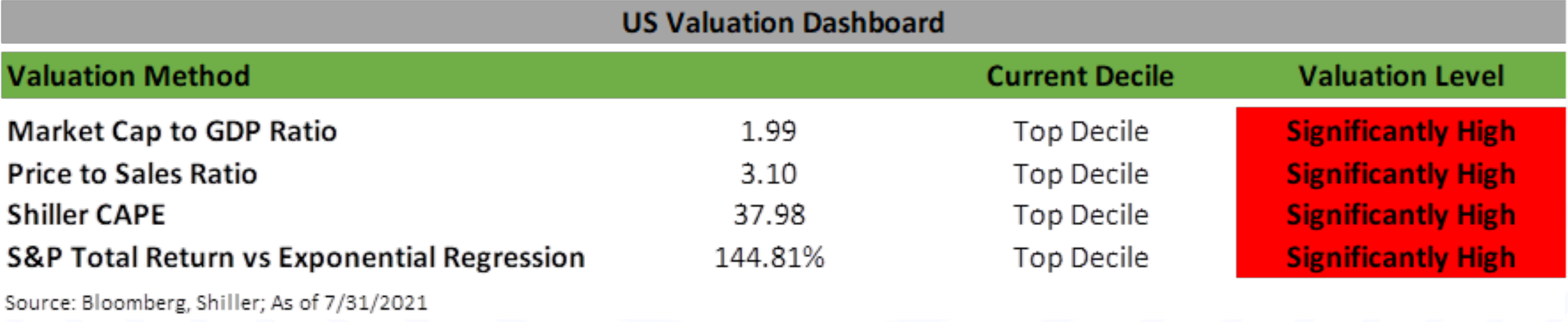

The WealthShield US Valuation Dashboard indicates the S&P 500 is in the top decile of all observed valuation indicators. This suggests future returns over the next 10 – 12 years are likely to be lower than what we’ve been witnessing. Therefore, we like private assets, alternatives, and dynamic strategies over traditional public assets. Turning our attention to private market valuation levels, however, we notice valuations also appear elevated. That said, we think there is more justification and less concern around the premium. In the below chart we illustrate current valuation levels, comparing the S&P 500 to the private equity buyout markets – keeping it domestic for this exercise.

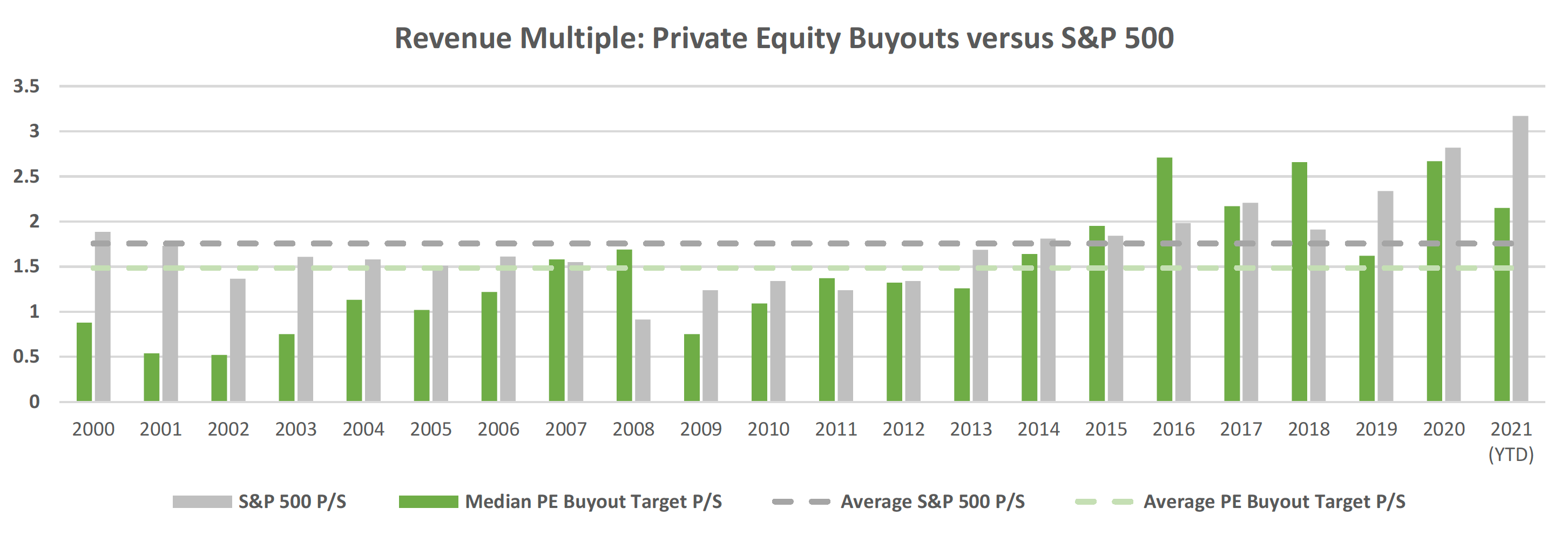

The chart above shows the trend of the P/S multiple of the S&P 500 versus Private Equity Buyouts, according to Bloomberg data. We use private equity buyout multiples as a valuation indicator as it is an actual transaction. Valuations are elevated in either case, as the chart portrays. At the time of this report, the S&P 500 was trading at nearly a 3.2x multiple on sales, an 80% premium above its 20-year average. Private Equity buyouts YTD are trading at a smaller premium of 45%, with multiples around 2.2x on sales. Private equity, by this measure, has less distance to compress if mean reversion was to occur. This is the first distinction between the private vs. public market valuation indicators.

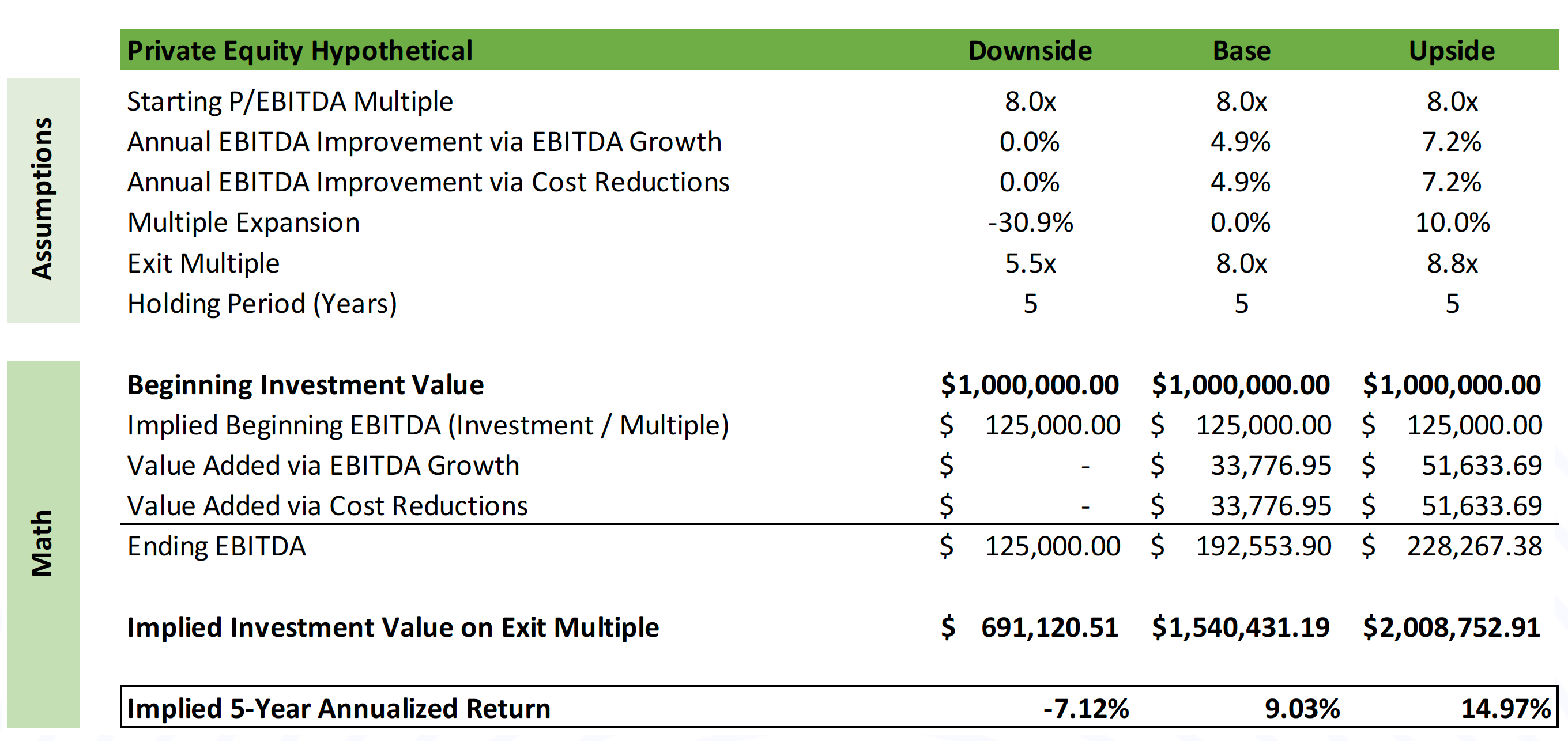

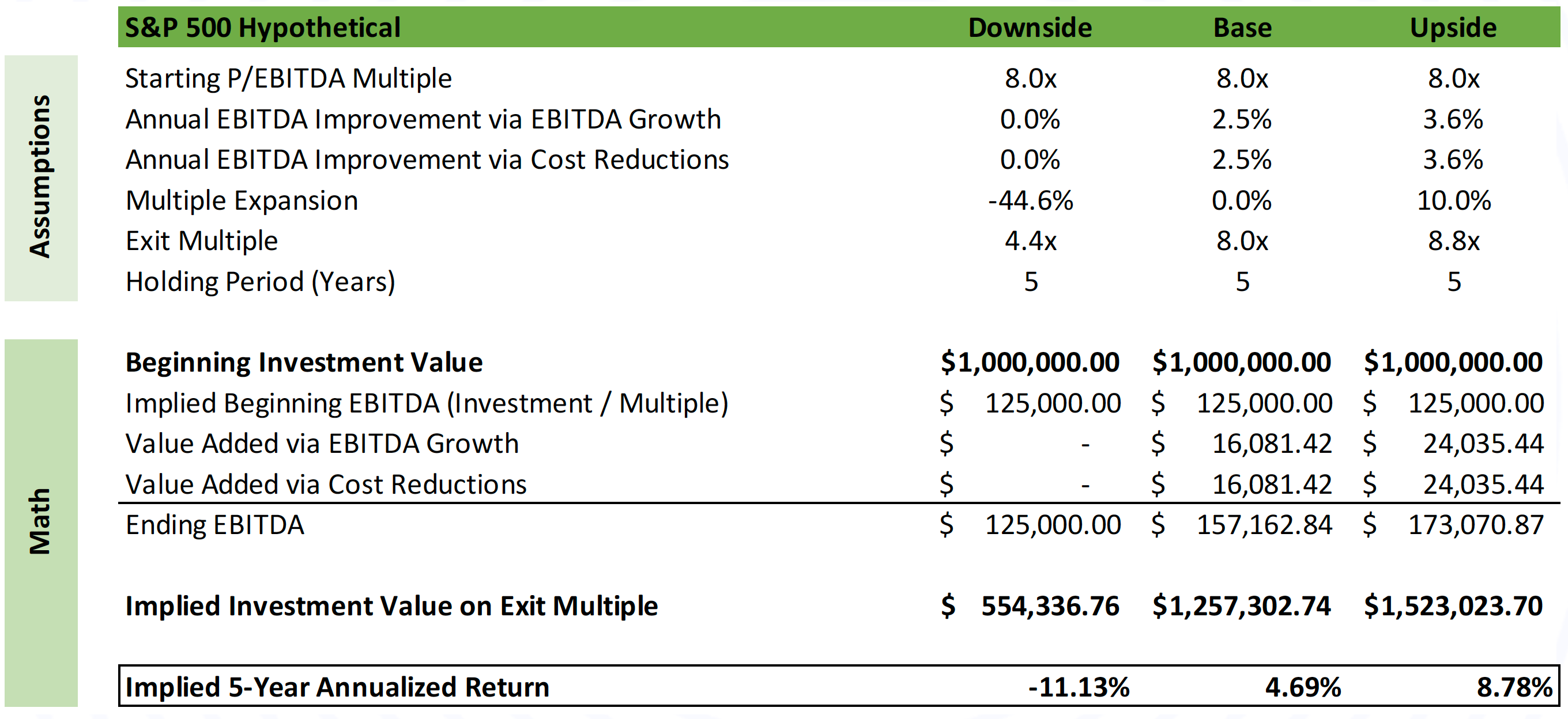

The second reason a premium may be warranted in the private space versus the public space is because of manager skill. We believe skilled managers have a strong ability to grow the top-line and improve the bottom-line. Financial improvements can most often be produced via top-line growth and margin expansion. We believe this is an easier accomplishment with skilled managers in the private universe compared to public companies. First, private companies can implement changes more quickly and with less restriction than a public company given the size differential and less board/shareholder approval requirements, etc. Second, managers gain access to companies earlier in the business life cycle. Younger companies carry less financial efficiency than public companies that have been operating significantly longer. Inefficiencies offer more opportunities for a skilled manager to expand margins. Additionally, younger companies typically have higher growth rates. Ultimately, private markets, especially top managers, allow for investors to align with sponsors who can drive value more efficiently and predictably than public markets. Top quartile managers have historically delivered significant value relative to average managers. Below we depict a hypothetical scenario of how skilled Private Equity managers can generate alpha over time versus public companies.

Downside Scenario: we assume multiples compress proportionately against the current P/S premium observed in the private and public markets. Additionally, we would expect no EBITDA growth or cost reductions over five years. You can see the worst-case scenario results in smaller losses due to reduced multiple compression.

Base Scenario: we assume multiples stay flat for five years. We assume the S&P 500 grows EBITDA at 4.9% annually, split between growth and cost reduction; this is the actual 10-year historical growth rate. This growth rate is arguable aggressive given market strength over the past 10 years. We assume Private Equity can double that growth rate. The ability of a skilled manager is reflected here with double the returns.

Upside Scenario: we assume multiples increase 10% over the next five years. We assume the S&P 500 grows EBITDA at 7.2% annually, split between growth and cost reduction; this is the actual 5- year historical growth rate. We assume Private Equity can double that growth rate. The ability of a skilled manager is reflected here, delivering additional alpha.

Again, the tables and scenario analysis above are completely hypothetical and are only meant to display our hypothesis on manager skill. It is a simple way to illustrate, in numbers, how reduced multiple compression and manager skill can add tangible value versus the public markets.

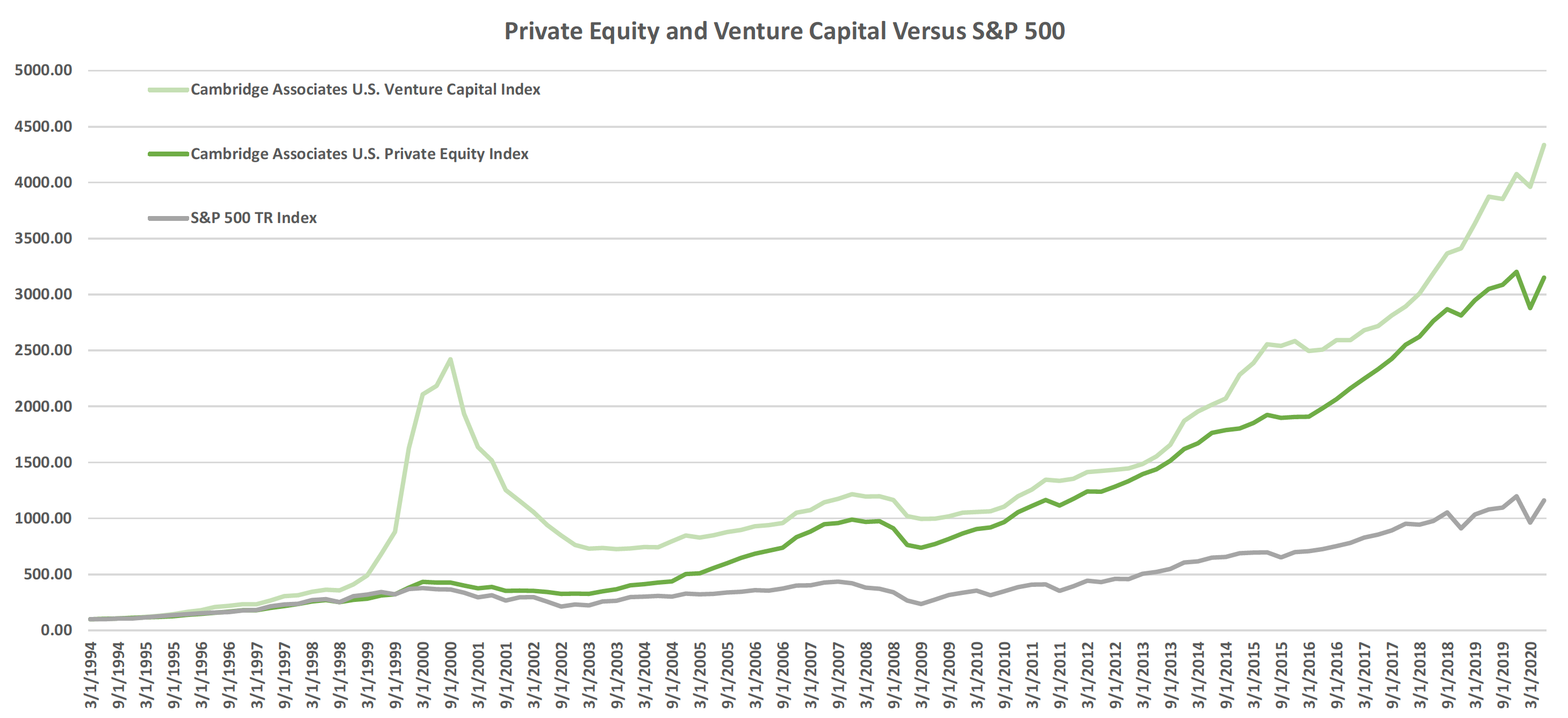

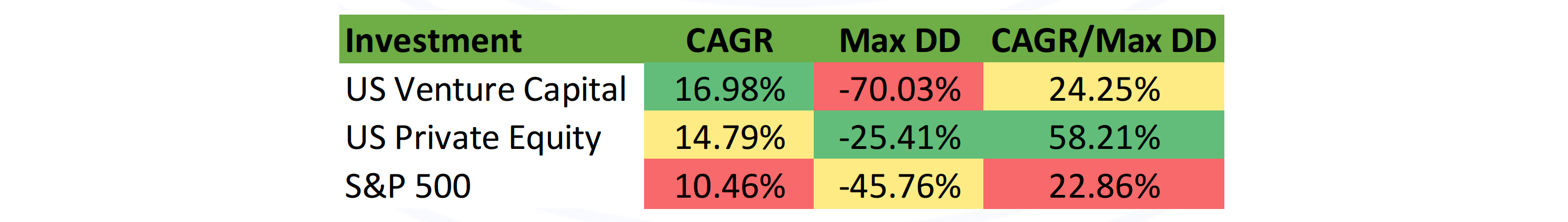

Another reason we prefer private assets over public assets is because of the potential for return enhancement, along with drawdown benefits within certain investments. Below we highlight historical returns from US Venture Capital, US Private Equity and the S&P 500.

Historically, Venture Capital and Private Equity have generated tremendously higher returns than the S&P 500 based on the respective Cambridge Associates indexes. We believe alpha can be generated in the private space due to the points mentioned in previous sections. Additionally, dampened drawdown, as seen in Private Equity, can help generate stronger returns.

Note, venture capital is largely a return enhancer and requires thorough due diligence of opportunities and well-timed allocation given its greater risk. Valuations, economic cycles, position sizing, sectors, managers, etc. must all be thoroughly considered before allocating to private investments, especially venture capital.

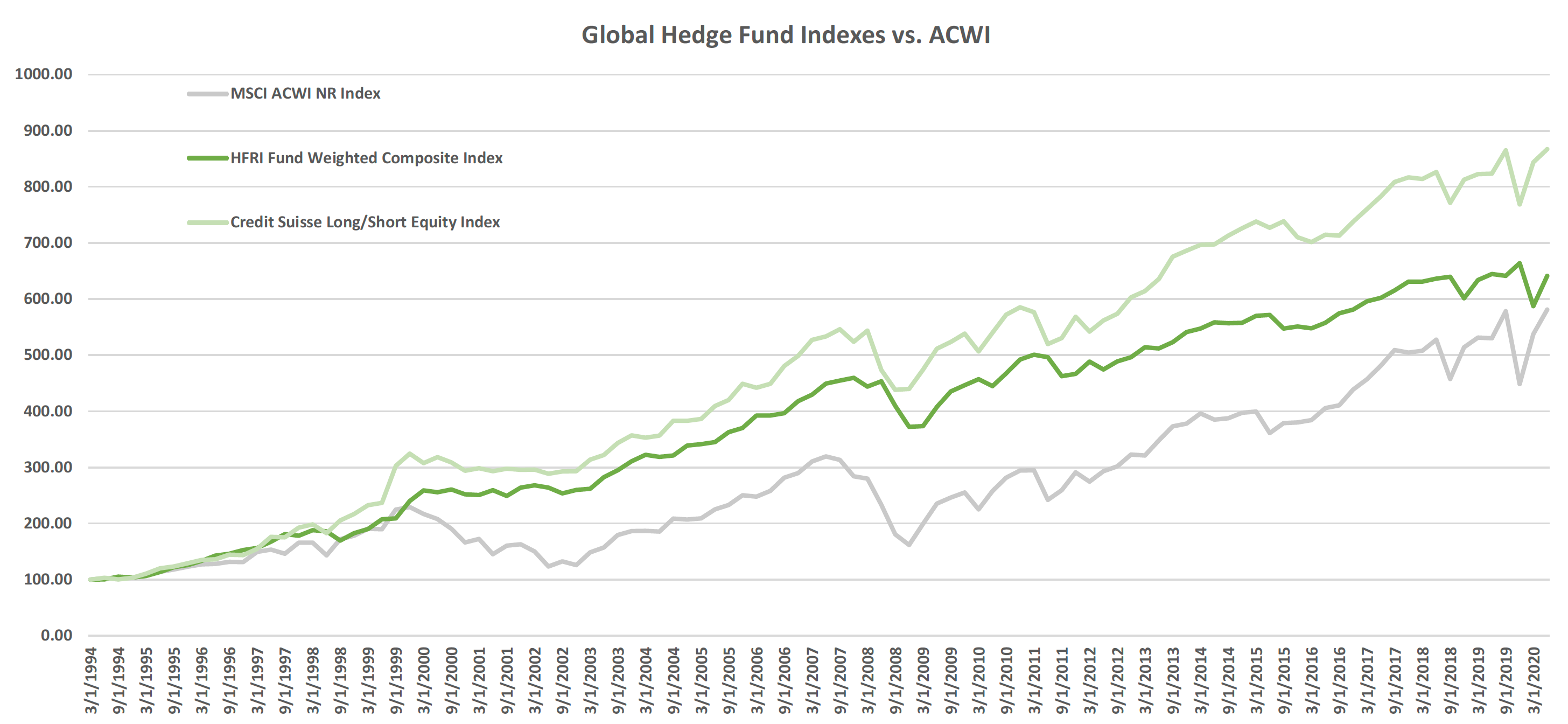

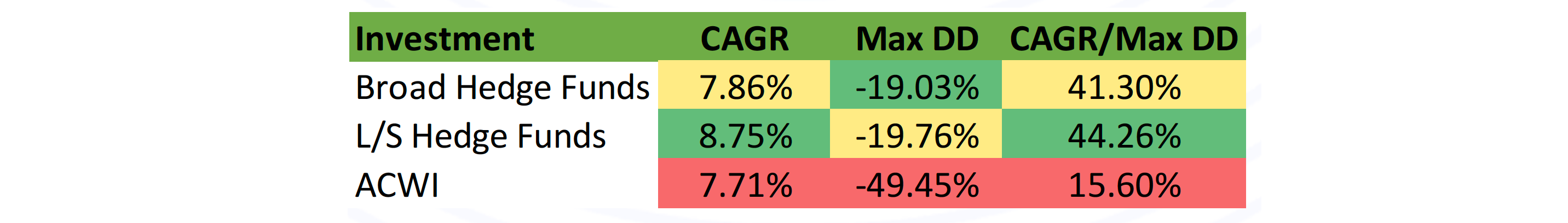

We like Hedge Fund exposure in the current valuation environment, especially Long/Short Hedge Funds given the short exposure. Hedge Funds offer a way to diversify away from long only public equity positions in a portfolio. Skilled portfolio managers typically offer downside protection and large downward moves are typically preceded by elevated valuations. The ability to have short positions within a portfolio, at all-time high valuations is critical for portfolio risk mitigation.

The above table illustrates the historical consistency of global hedge funds and L/S indexes versus a global public equity benchmark. Returns are anticipated to be superior or in-line with benchmarks, but the significant drawdown reduction is one of the key value-adds from skilled hedge fund managers (see below).

Lower risk results in materially greater risk-adjusted return profiles versus benchmarks, and ultimately allows investors to maintain their positions and achieve their financial goals.

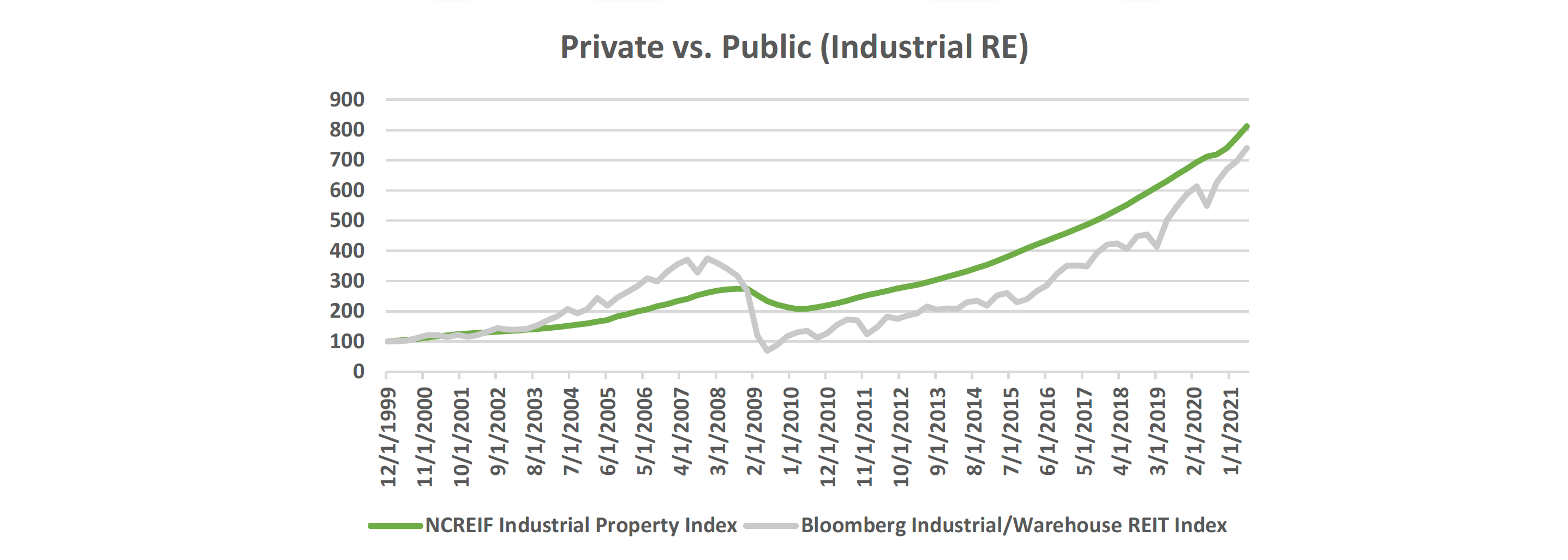

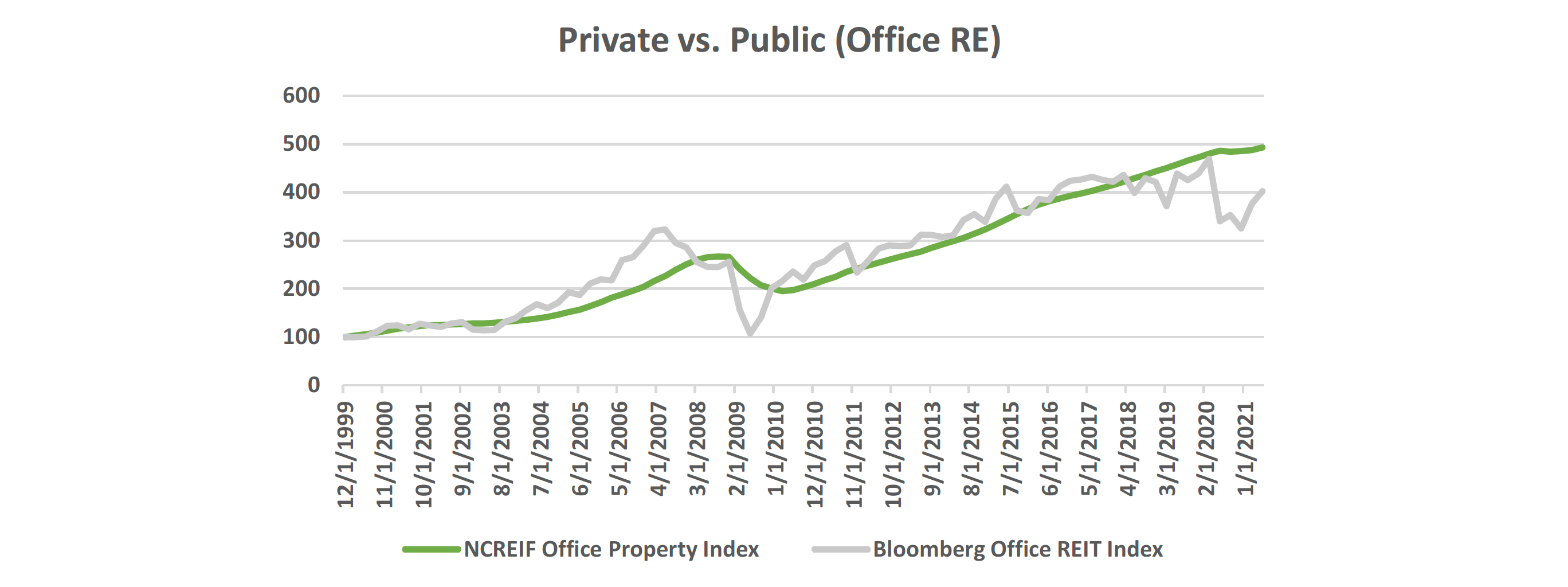

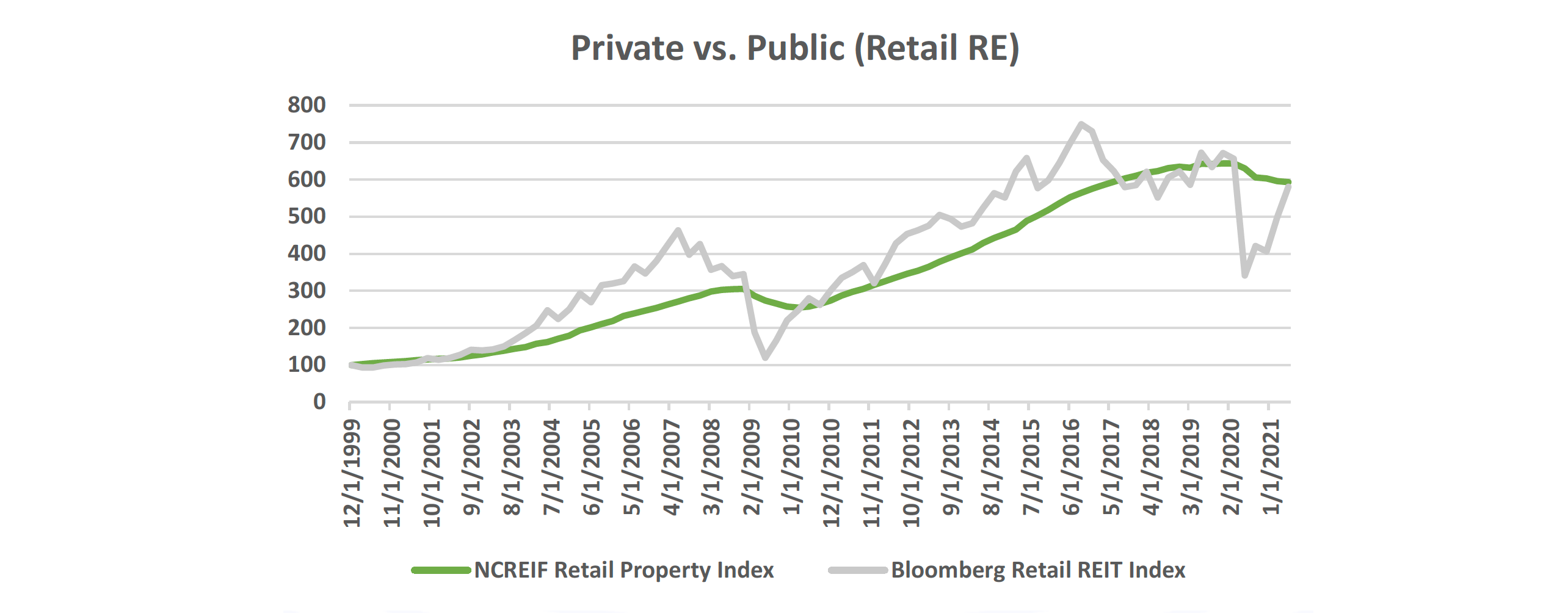

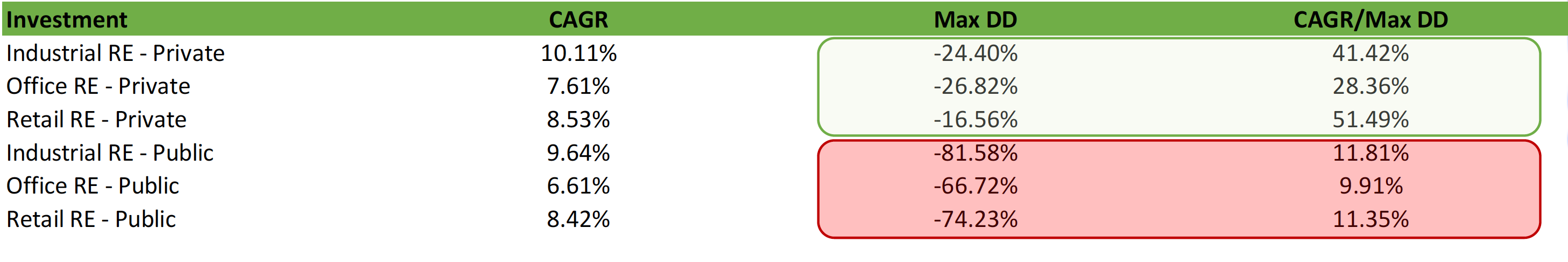

Below we compare historical returns and risk of the industrial, office and retail real estate spaces. The comparisons show private indexes versus public indexes. Again, private assets provide substantially higher risk-adjusted returns, minimizing drawdown significantly.

While the mathematical side of private investments demonstrates the potential for outperformance relative to public assets, we wanted to take a closer look at the behavioral side. In order to do this, we evaluated behavioral biases that drive investment behavior and ways that private and public markets might be influenced by these biases.

Daniel Kahneman is well-known for his work on prospect theory, which is a behavioral model that shows how people decide between alternatives that involve risk and uncertainty (Kahneman & Tversky, 1979). While there are quite a few takeaways from the study, the one we’ll focus on for this discussion is loss aversion, which ascertains that “losses loom larger than gains” (Kahneman & Tversky, 1979). According to Kahneman, the pain from losses is psychologically at least twice as powerful as the pleasure of a similar gain.

Myopic loss aversion is the combination of a greater sensitivity to losses than to gains and a tendency to evaluate outcomes frequently. This leads individuals to take an extremely shortterm assessment of the recent performance and react excessively to that performance, particularly losses, at the expense of long-term benefits (Thaler et al., 1997).

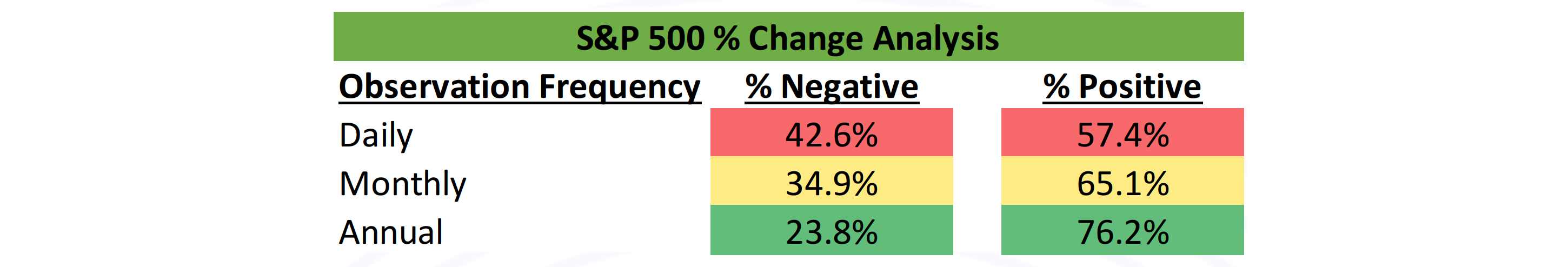

Loss aversion tells us as investors that we should look for opportunities that will produce fewer losses. There are two ways to reduce the number of times an investor sees a loss; 1. produce more positive returns (and thus fewer losses) or 2. produce fewer observation points so that losses are not as frequent. The first point of creating more positive returns is a great goal that every investor has, and as we reviewed earlier, we do believe that private investments provide more opportunities for these positive returns. However, positive returns are not a certainty. With every investment there is risk, so there will be losses from time to time in a portfolio.

Technology has been a huge benefit to the investing world at large, giving investors more transparency with constant notifications and updates as often as an investor would like to view. Information within performance reports that used to arrive by mail once a quarter or year is now available at an investor’s fingertips 24/7. While much of technology has improved our industry, it has made loss aversion more prevalent than ever before. Many clients check their balances daily.

This is in opposition to our previous point 2, knowing that we want to provide fewer opportunities for loss observations not more. The chart below demonstrates how often you’re likely to feel losses depending upon how often you check your account.

The structure of private investments and what many view as a negative of private investments is in fact a strong positive for behavioral finance. Private investments have lower liquidity than their public counterparts.

To start, a private investment in a hedge fund oftentimes will have a lockup period, or a period after the investment when an investor cannot redeem or sell. While this removes liquidity from the investment, this does solve for the myopic loss aversion bias that an investor might face if that fund performed poorly in its first quarter and the investor immediately wanted to exit the strategy. They’d be letting one poor period negate all potential future returns from the strategy. Ideally, an investor will have more conviction of a strategy or manager than could be damaged by one or two poor quarters at the inception of an investment. If not, an investor should perform more adequate due diligence before making an investment in the first place.

Beyond lockups, private equity, credit, and real estate funds are most commonly structured as limited partnerships with a targeted fund life of 5-10+ years. An investor is required to hold for the entirety of this period with the only exit opportunity being in the secondary market, which is sure to be significantly discounted if it’s available at all. Again, from a liquidity perspective this is extremely limiting, but from a behavioral perspective this keeps an investor engaged and invested in their investment plan. An investor isn’t always going to be able to time the market or business cycle perfectly, so it’s important that no matter how markets run or slump, an investor stick to their target plan. One of the most dangerous moves in investing is to deviate from that plan, particularly when it’s an emotional response to a loss.

Beyond illiquidity, private investments’ reporting style helps to solve for loss aversion. Reporting on a quarterly basis reduces the number of observations so that a daily, weekly, or monthly dip may not even be noticed. Additionally, because many of these positions are not often marked to market, deviations in price and return tend to be dampened significantly. Oftentimes, the value of an underlying position can’t be known until the fund finalizes a sale of that asset, which can be years after the initial purchase. The fluctuations up and down aren’t felt as severely because there isn’t an actively traded market for that investment like there is in the public space. On a similar note, performance reports for private investments are always somewhat delayed, therefore the price isn’t “live” even when you receive the performance update. For example, an investor in a private fund in Q1 of 2021 would be fully aware of the negative risk asset performance in Q1 due to the pandemic, but they wouldn’t receive their performance until a few weeks into Q2 at the earliest. By that time, they’ve had a chance to mentally prepare themselves that that performance isn’t going to be pretty, and they’ve gotten a sneak peek into the next quarter when assets were able to recover. It is our opinion that this removes some of the emotion and fixation on each report.

In conclusion, there is a great deal of value in allocating to private investments, from a theoretical, mathematical, and behavioral perspective. Public markets are exhibiting some of the most extreme valuations in history and we think clients’ needs for creative and alternative investment solutions are escalating. We’ve discussed various subsets of hedge funds, private equity, private credit, and private real estate. These investments can all play a role within client portfolios, provided thorough valuation and economic cycle analysis, investment due diligence and operational due diligence. Diversification, risk mitigation and behavioral palatability are critical components of investors sticking to and reaching their financial goals, and we believe private allocations offer these benefits.

Additional Sources:

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263-291.

Thaler, R. H., Tversky, A., Kahneman, D., & Schwartz, A. (1997). The effect of myopia and loss aversion on risk taking: An experimental test. The Quarterly Journal of Economics, 112(2), 647-661.