Understanding Feeder Funds and Six Reasons Advisors Need to Launch Their Own

Understanding Feeder Funds and Six Reasons Advisors Need to Launch Their Own

By: David Stefanick, CFA

September 11th, 2023

Download PDF

Download PDF

The term “Feeder Fund” is commonplace in the alternatives space, and for good reason. Feeder funds offer incredible benefits to investors, making an institutional-quality private asset program possible for advisors, family offices and high net worth individuals. New entrants to the private asset space may not fully understand what these feeder funds are, so our goal is to introduce feeder funds to help build an understanding of these funds, and then describe six potential benefits and use-cases.

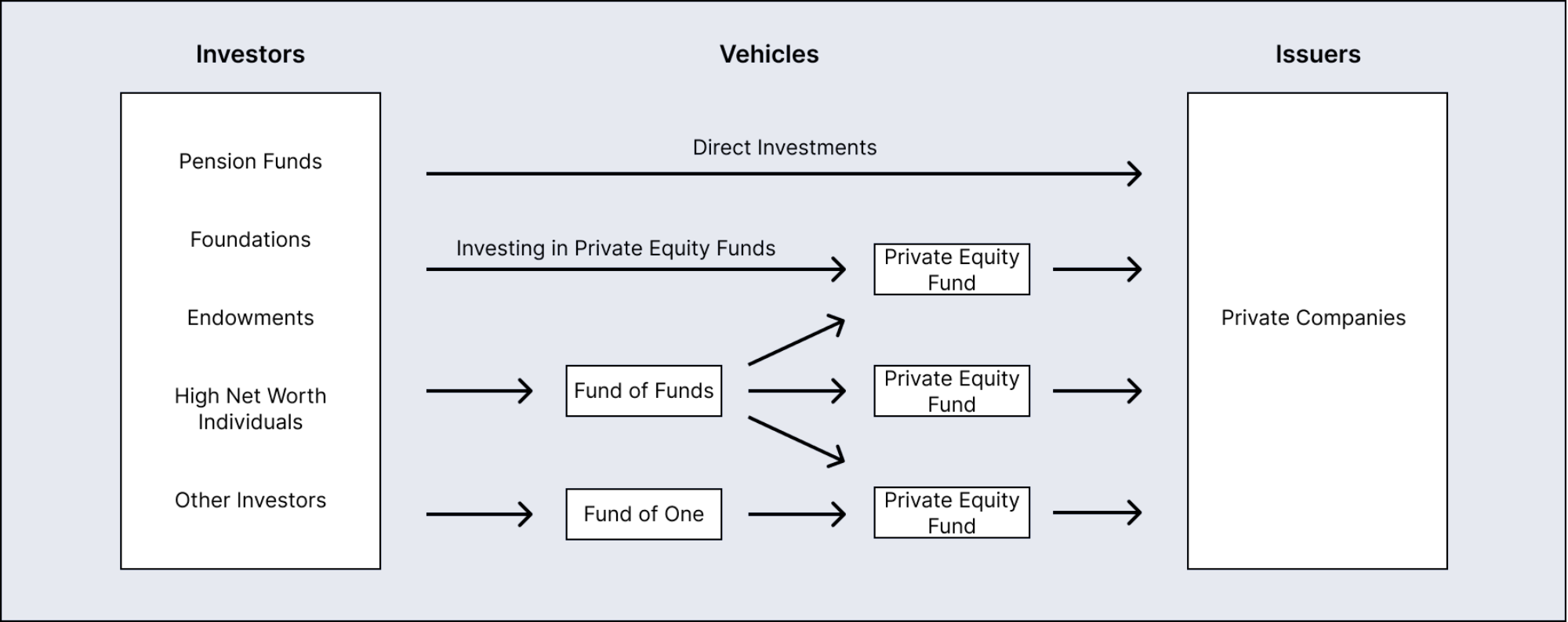

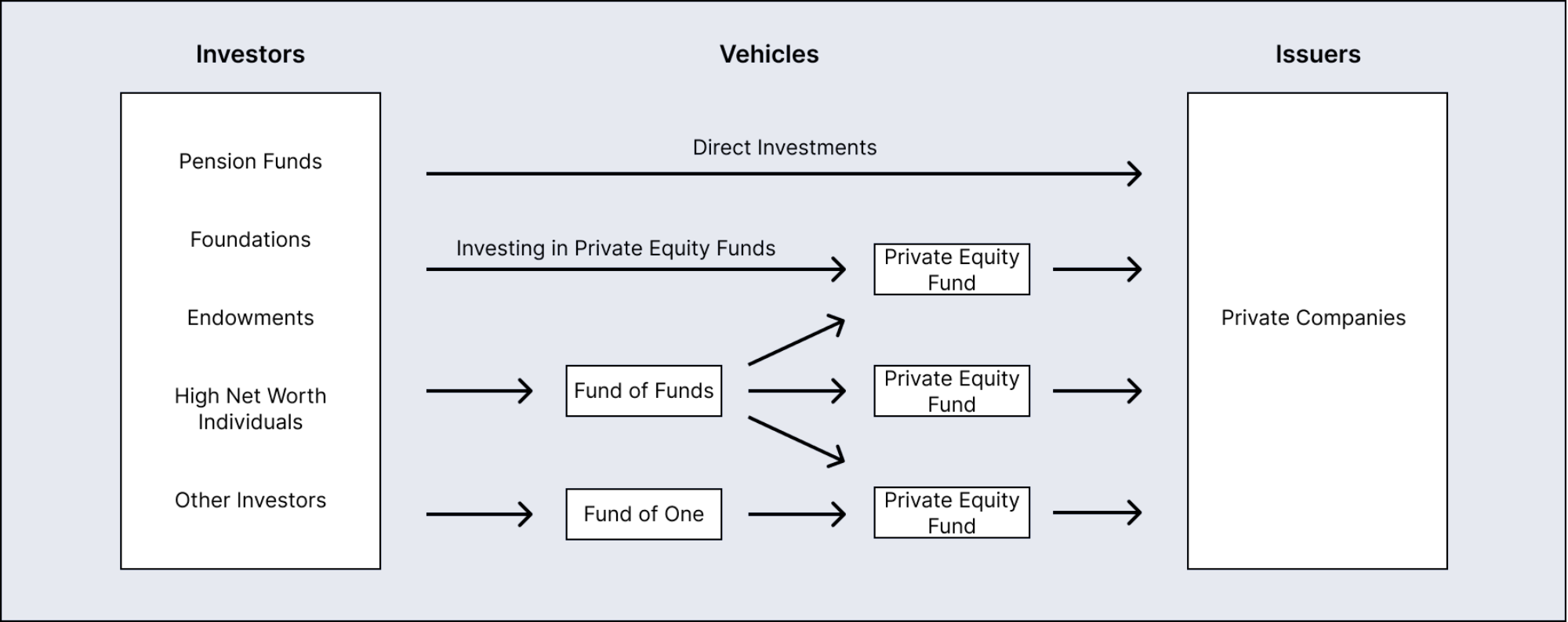

To understand a feeder fund, one should understand what a private investment fund is. A private investment fund is an investment vehicle designed to pool multiple investors’ capital to make investments on behalf of the collective investors. Think of a hedge fund or a private equity fund. A private equity fund is an investment vehicle, often set up as a Limited Partnership, which pools the capital of its investors (the Limited Partners) and invests in the equity and debt of privately held companies. The investments are selected by the General Partner, who is the sponsor of the fund and who investors think of as the investment manager of the fund.

In the exact same way, a feeder fund is an investment vehicle. Feeder funds are commonly set up as limited partnerships, pooling the capital from multiple investors (the Limited Partners) and investing it. In a feeder fund, the investments are often into other private funds. A feeder fund that invests in multiple private funds is known as a fund of funds. A feeder fund that invests in a single private fund is sometimes referred to as a fund of one, or an access vehicle.

So, why would we need an investment vehicle to invest in other investment vehicles? It’s a great question. Below are six opportunities expanded by feeder funds.

- Accessibility

- Private funds can often have higher minimums than an investor is capable of or willing to allocate. Many private equity funds have minimums of $10 million dollars or more. By building a feeder fund, we could aggregate 100 investors at $100,000 each to meet that fund’s minimum. Our investors can gain access to that exclusive opportunity but with a much lower minimum investment.

- Diversification

- If we look at the previous example, an investor with $10 million dollars in investable assets earmarked for private equity could theoretically invest in that one private equity fund with a $10 million minimum. However, a rational investor would never allocate 100% of their investable assets into one specific fund. They’d want to diversify across vintages, strategies, sectors, geographies, as well as to assets outside of private equity. We could build a feeder fund that allocates to 10 different private equity funds, diversifying its investors to achieve better risk-adjusted returns. Additionally, we can keep the minimum on our feeder fund to $100K to make it more accessible to investors.

- Consolidation

- Advisors with an extensive private asset program may have investments in 100 or more private deals and funds. To make this scalable and ensure that similar clients with similar constraints and objectives have access to similar opportunities, an advisor can consolidate those opportunities into one, or a selection of, feeder funds. This ensures no preferential treatment of one investor over another since all investors in the fund will have the same proportionate allocation to each investment.

- Simplification

- If we think about this advisor with 100 private deals and funds to invest in, it takes a significant operational lift to allocate a new client. A feeder fund simplifies the process for investors dramatically.

- Prospecting – Only one fund for clients to evaluate marketing information, legal documents, historical performance, and other fund data.

- Subscription Process – New clients are only investing in one fund as opposed to 100, simplifying the paperwork process by 99%.

- Tax Reporting – By aggregating investments in a feeder, investors would only receive one tax document from the feeder fund, as opposed to one from the 100 underlying investments.

- Monetization

- RIAs looking to improve profitability can generate revenue by charging fees on their feeder funds. These fees can be charged as management fees, incentive fees, or a variety of other flexible fee structures. Work in the alternative investment space is valuable and differentiating work for their end-clients; advisors should be compensated for this value-add.

- Fee Breaks

- Because feeder funds aggregate your clients into one investor to the underlying private fund, those underlying sponsors are more likely to give fee breaks when you reach critical mass. Just like feeder funds lighten operational burdens for your firm, they reduce the investor count and brain damage to your underlying fund sponsors.

Understanding Feeder Funds and Six Reasons Advisors Need to Launch Their Own

Understanding Feeder Funds and Six Reasons Advisors Need to Launch Their Own